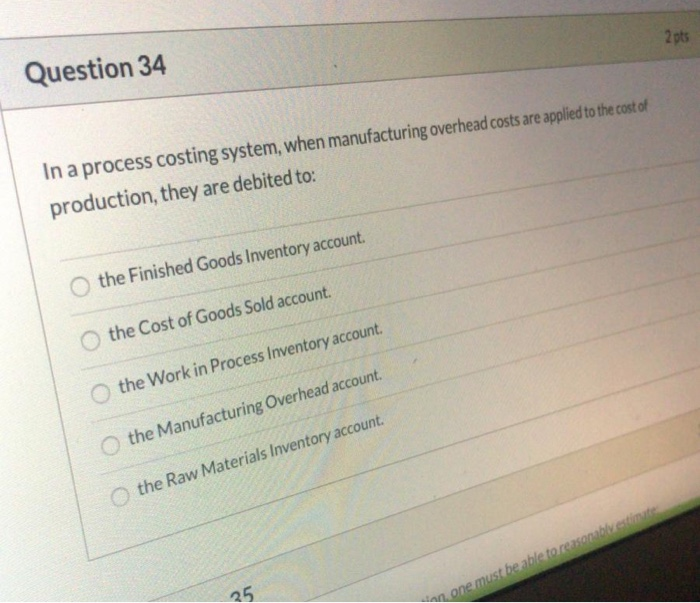

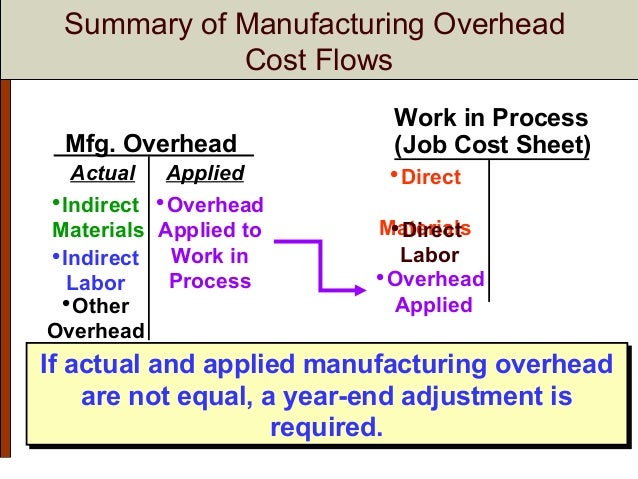

In A Process Costing Systemwhen Manufacturing Overhead Costs Are Applied

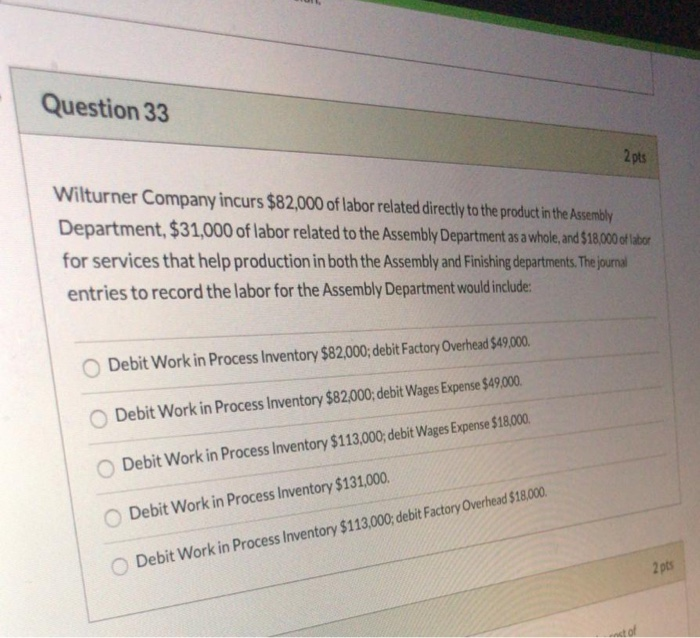

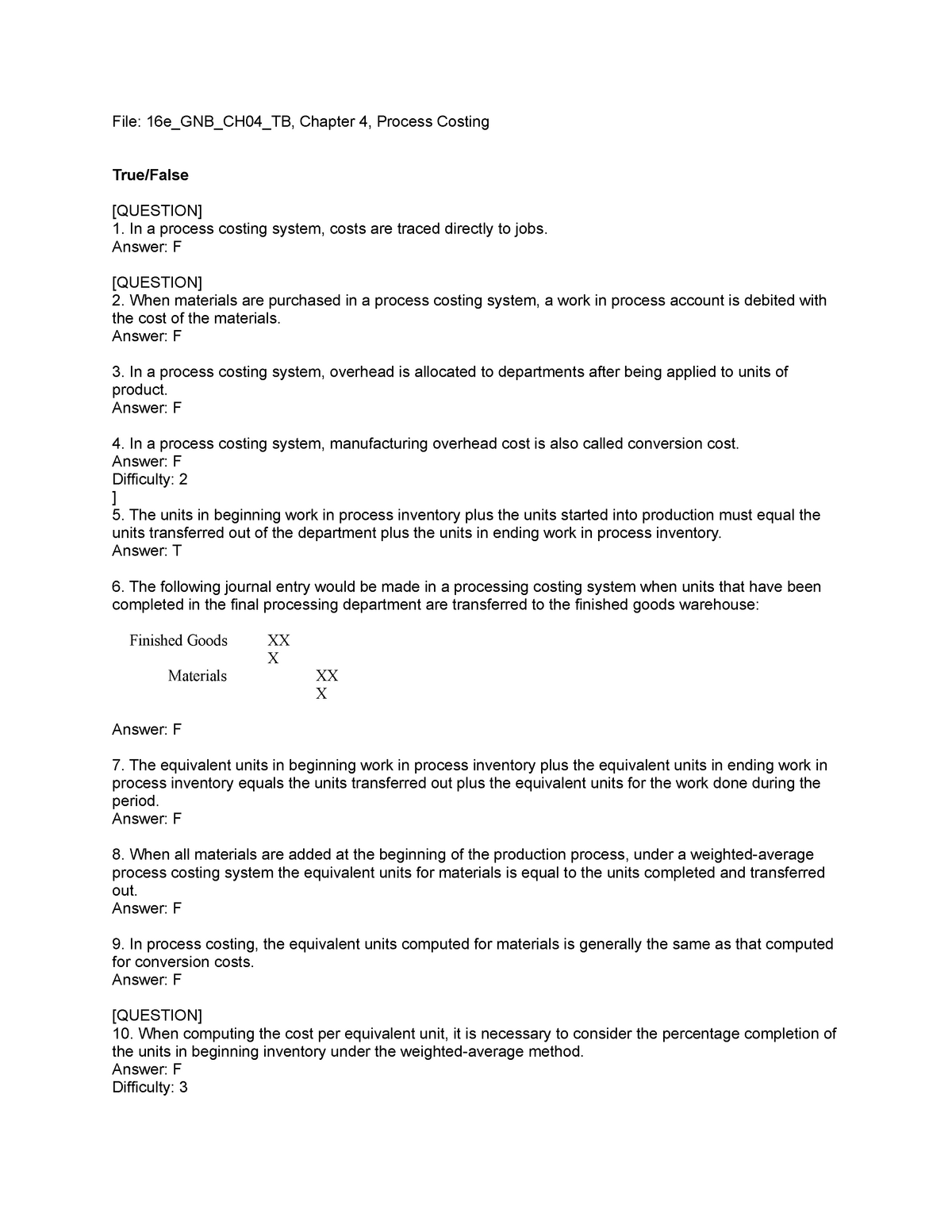

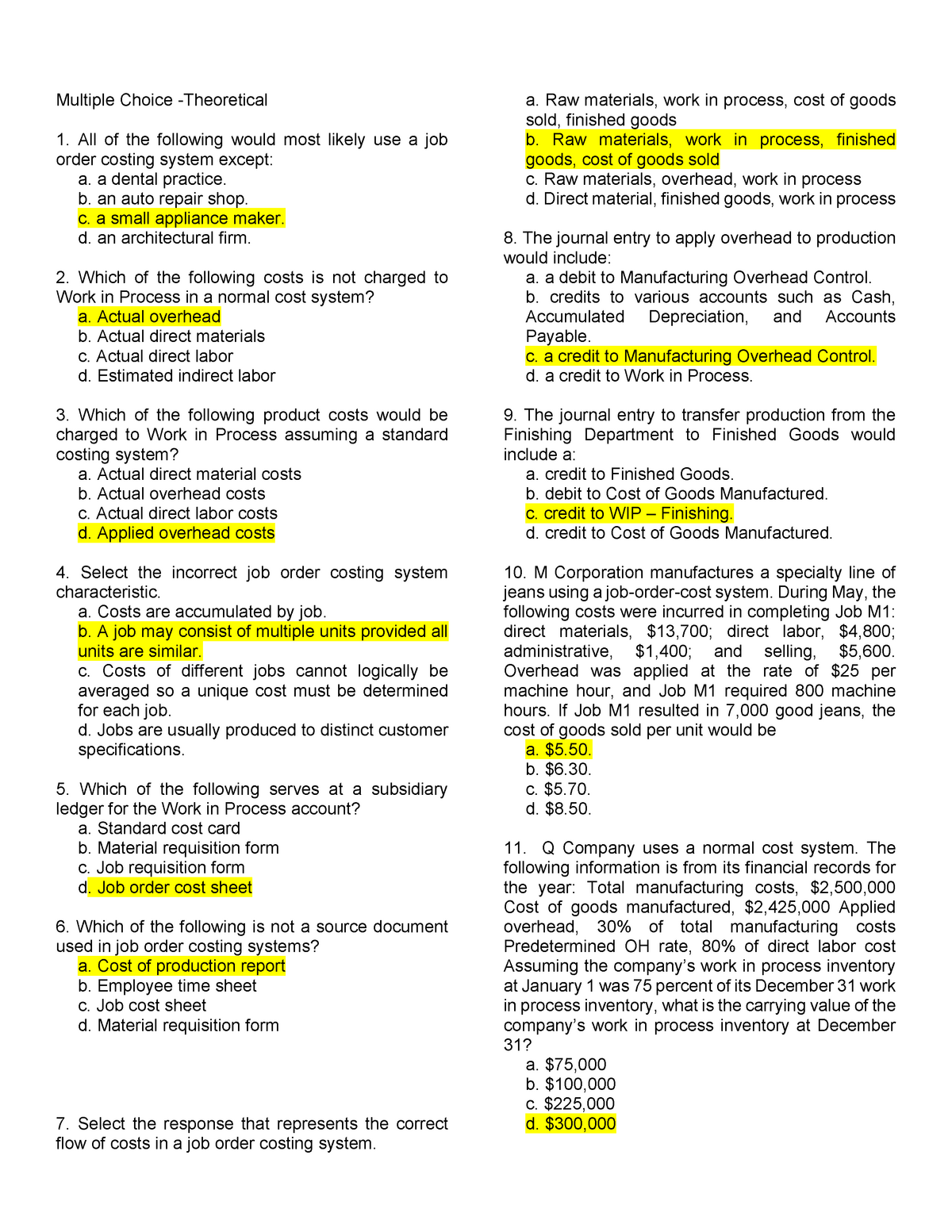

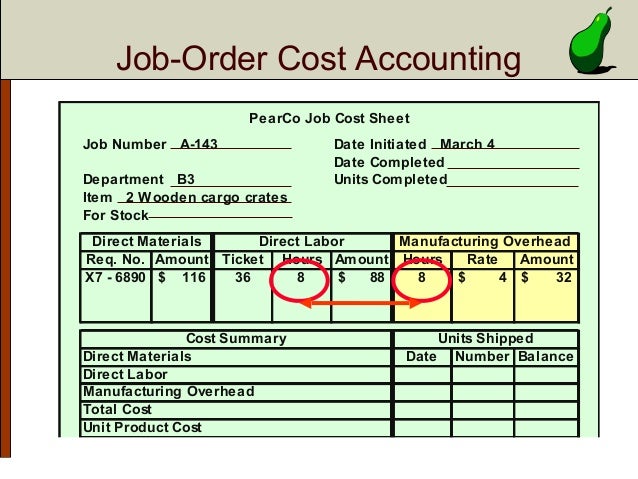

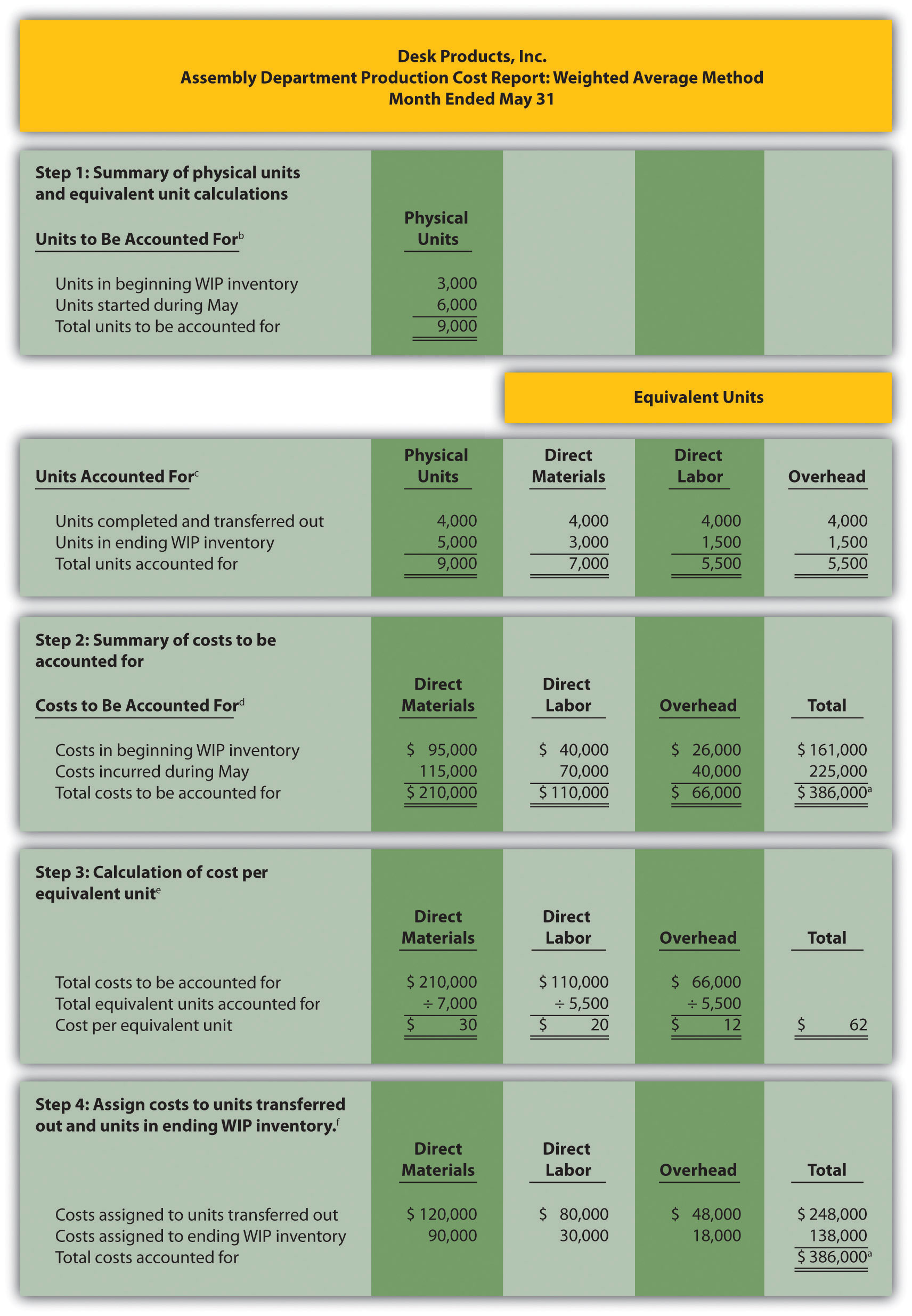

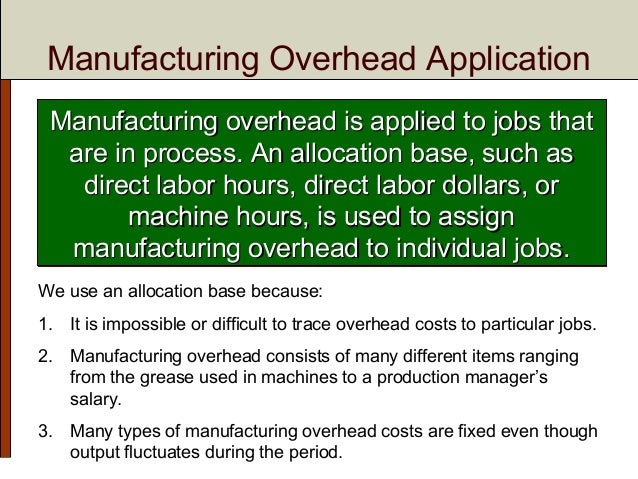

In a process costing systemwhen manufacturing overhead costs are applied. A Manufacturing overhead control b Manufacturing overhead applied c Finished goods control d Work in process control Gleim 225 229 2210 combined. The combined costs of direct labor and factory overhead per equivalent unit used by many businesses with process operations is called. Predetermined overhead rate times the actual manufacturing overhead incurred on the particular job.

Benchmore applied estimated manufacturing overhead costs to the Car 11 job. Combines costs and outputs from the current and prior periods. Asked Jan 10 2019 in Business by maju88 A the Finished Goods Inventory account.

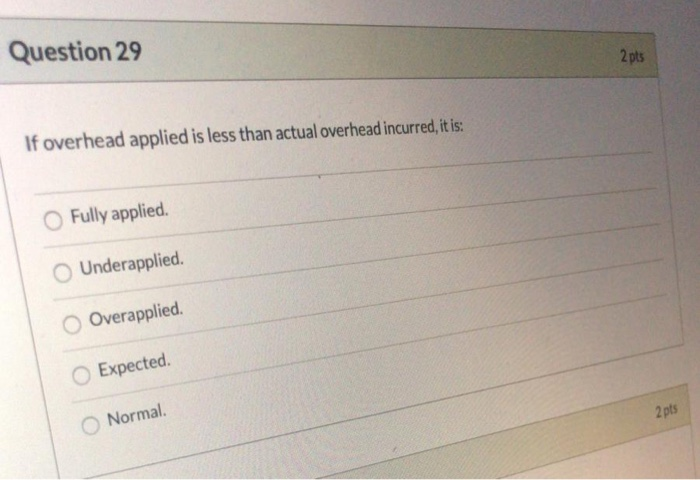

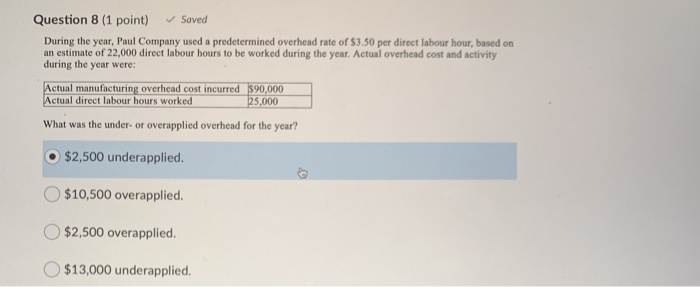

If Olly Company applied 15600 of estimated overhead cost to production and actual overhead costs were 15200 then overhead was _____. In a job order cost system the use of direct materials direct labor costs and the application of manufacturing overhead is reflected in the general ledger as an increase in. Applied based on actual costs incurred in each department.

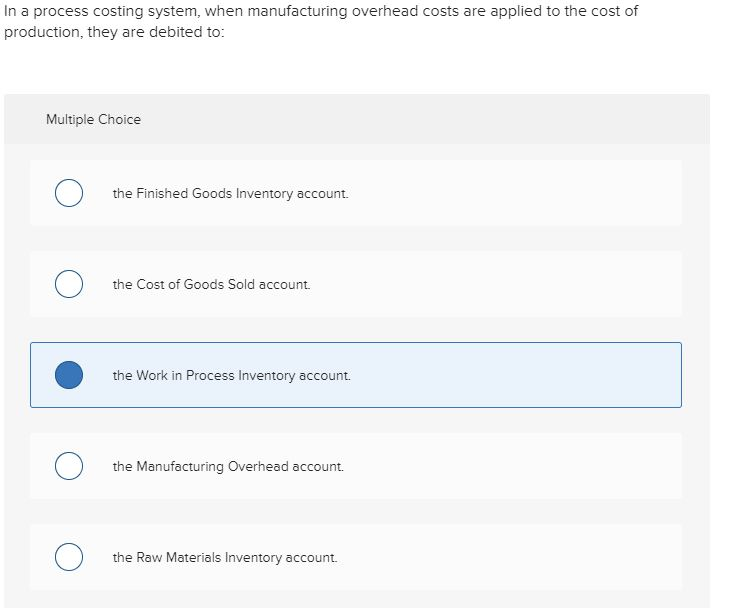

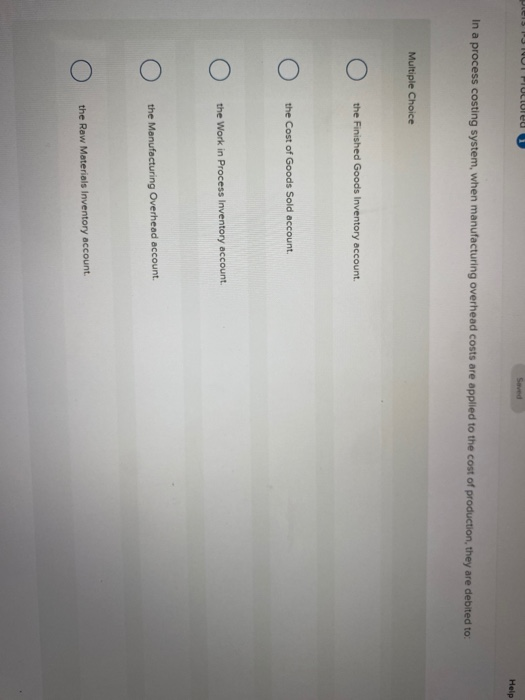

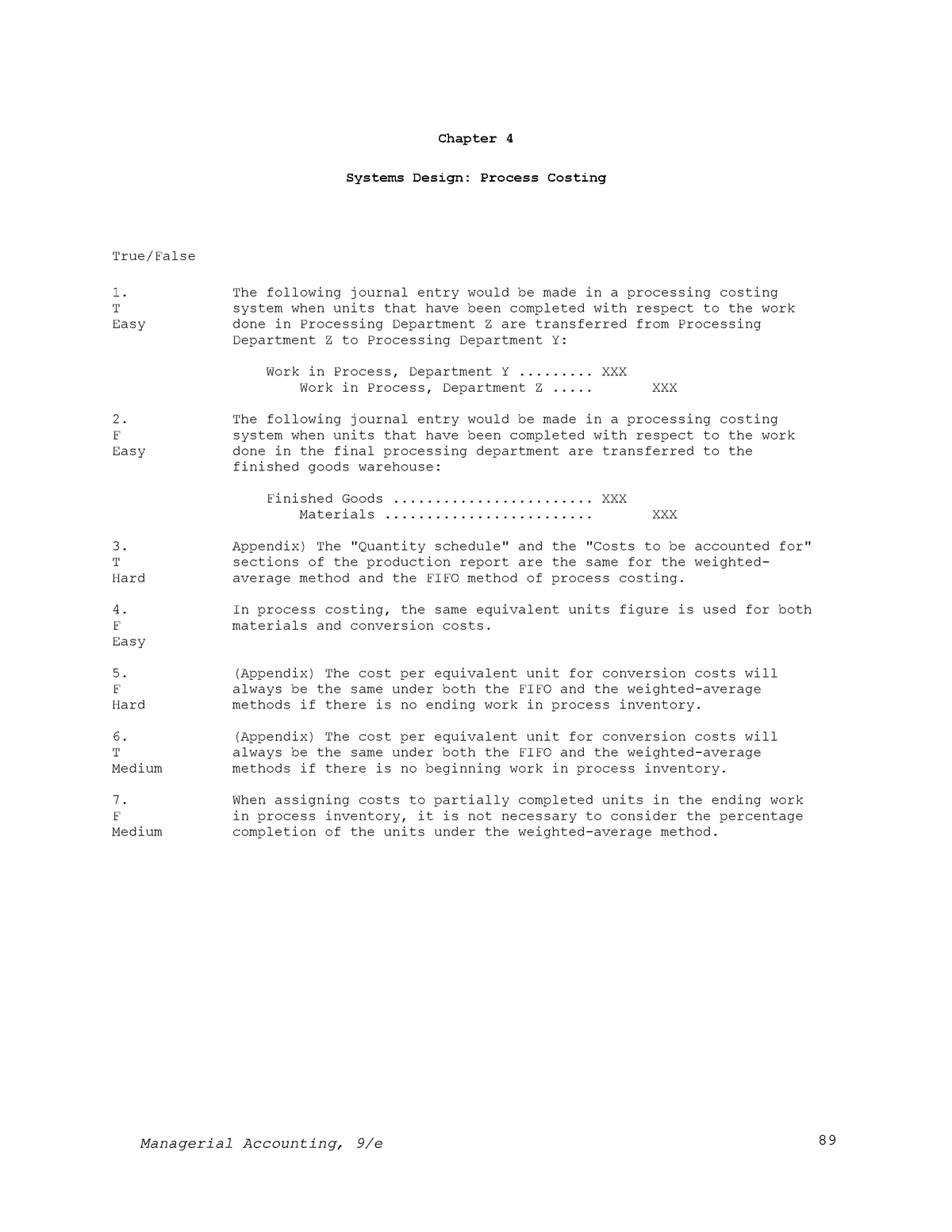

In a process costing system when manufacturing overhead costs are applied to the cost of production they are debited to the Work in Process Inventory account. The Cost of Goods Sold account. In a process costing system overhead is allocated to departments after being applied to units of product.

In a process costing system when manufacturing overhead costs are applied to the cost of production they are debited to. Generally applied using a predetermined overhead rate D. Bases costs solely on the costs and outputs from the current period.

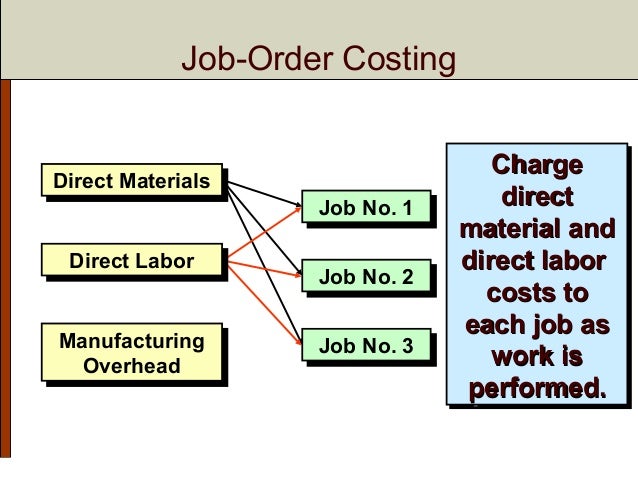

The cost flows in a process costing system are similar to the cost flows in a job costing system. The Manufacturing Overhead account. B only if the overhead costs can be directly traced to that job.

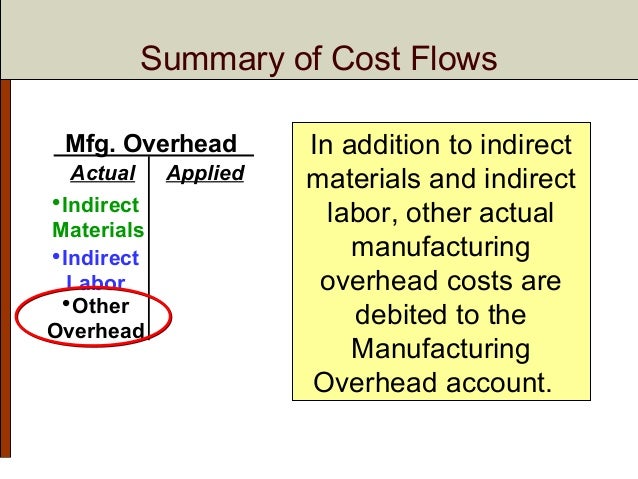

In a process costing system when manufacturing overhead costs are applied to the cost of production they are debited to. Manufacturing overhead is composed of the cost incurred in the manufacturing process that is not directly traceable to the final product.

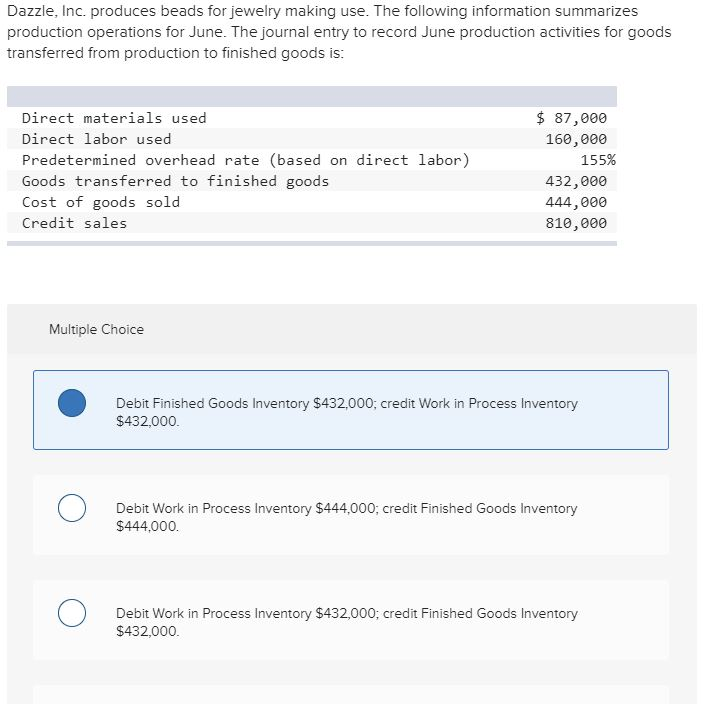

Work-in-process inventory materials inventory finished goods inventory cost of goods sold.

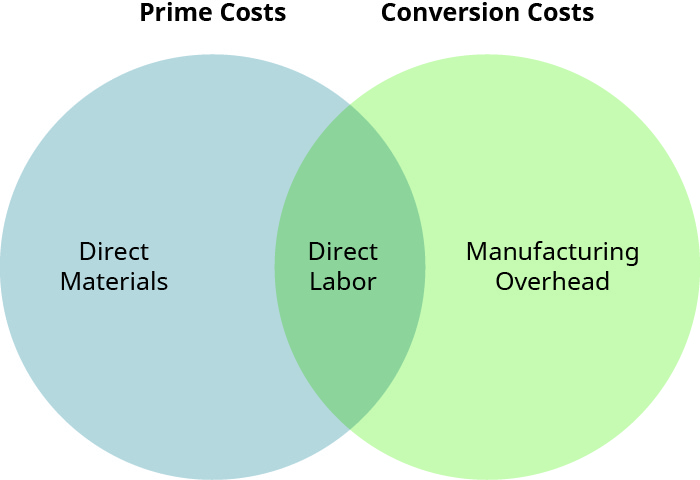

In the manufacturing process partially or partly completed goods that are still in the process of being converted into a finish product are defined as work-in-process inventories. Manufacturing overhead is applied to each job a at the end of the year when actual costs are known. The Work in Process Inventory account. In a process costing system when manufacturing overhead costs are applied to the cost of production they are debited to. The Cost of Goods Sold account. The Raw Materials Inventory account. False In a process costing system manufacturing overhead cost is also called conversion cost. Bases costs solely on the costs and outputs from the current period. When applying manufacturing overhead to jobs the formula to calculate the amount is as follows.

In a process costing system when manufacturing overhead costs are applied to the cost of production they are debited to. False In a process costing system manufacturing overhead cost is also called conversion cost. B only if the overhead costs can be directly traced to that job. The Finished Goods Inventory account. In process costing manufacturing overhead costs are. The Cost of Goods Sold. In a process costing system when manufacturing overhead costs are applied to the cost of production they are debited to.

Post a Comment for "In A Process Costing Systemwhen Manufacturing Overhead Costs Are Applied"